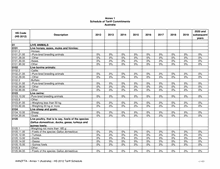

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8423

Weighing machinery (excluding balances of a

sensitivity of 5 cg or better), including weight

operated counting or checking machines;

weighing machine weights of all kinds:

8423.10.00 -Personal weighing machines, including baby scales;

household scales

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.20.00 -Scales for continuous weighing of goods on

conveyors

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.30.00 -Constant weight scales and scales for discharging a

predetermined weight of material into a bag or

container, including hopper scales

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.8

-Other weighing machinery:

8423.81.00 --Having a maximum weighing capacity not

exceeding 30 kg

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.82.00 --Having a maximum weighing capacity exceeding 30

kg but not exceeding 5 000 kg

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.89.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8423.90.00 -Weighing machine weights of all kinds; parts of

weighing machinery

0% 0% 0% 0% 0% 0% 0% 0% 0%

8424

Mechanical appliances (whether or not hand-

operated) for projecting, dispersing or spraying

liquids or powders; fire extinguishers, whether

or not charged; spray guns and similar

appliances; steam or sand blasting machines

and similar jet projecting machines:

8424.10.00 -Fire extinguishers, whether or not charged

0% 0% 0% 0% 0% 0% 0% 0% 0%

8424.20.00 -Spray guns and similar appliances

0% 0% 0% 0% 0% 0% 0% 0% 0%

8424.30

-Steam or sand blasting machines and similar jet

projecting machines:

8424.30.10 ---Electro-mechanical tools for working in the hand,

with self-contained electric motor

0% 0% 0% 0% 0% 0% 0% 0% 0%

8424.30.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8424.8

-Other appliances:

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

329 / 433