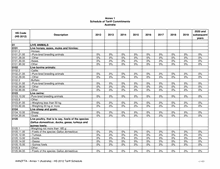

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8414.90.20 ---Of goods of 8414.40.20 or 8414.80.20

0% 0% 0% 0% 0% 0% 0% 0% 0%

8414.90.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415

Air conditioning machines, comprising a motor-

driven fan and elements for changing the

temperature and humidity, including those

machines in which the humidity cannot be

separately regulated:

8415.10.00 -Window or wall types, self-contained or "split-

system"

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415.20.00 -Of a kind used for persons, in motor vehicles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415.8

-Other:

8415.81.00 --Incorporating a refrigerating unit and a valve for

reversal of the cooling/heat cycle (reversible heat

pumps)

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415.82.00 --Other, incorporating a refrigerating unit

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415.83.00 --Not incorporating a refrigerating unit

0% 0% 0% 0% 0% 0% 0% 0% 0%

8415.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8416

Furnace burners for liquid fuel, for pulverised

solid fuel or for gas; mechanical stokers,

including their mechanical grates, mechanical

ash dischargers and similar appliances:

8416.10.00 -Furnace burners for liquid fuel

0% 0% 0% 0% 0% 0% 0% 0% 0%

8416.20.00 -Other furnace burners, including combination

burners

0% 0% 0% 0% 0% 0% 0% 0% 0%

8416.30.00 -Mechanical stokers, including their mechanical

grates, mechanical ash dischargers and similar

appliances

0% 0% 0% 0% 0% 0% 0% 0% 0%

8416.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8417

Industrial or laboratory furnaces and ovens,

including incinerators, non-electric:

8417.10.00 -Furnaces and ovens for the roasting, melting or

other heat-treatment of ores, pyrites or of metals

0% 0% 0% 0% 0% 0% 0% 0% 0%

8417.20.00 -Bakery ovens, including biscuit ovens

0% 0% 0% 0% 0% 0% 0% 0% 0%

8417.80.00 -Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

324 / 433