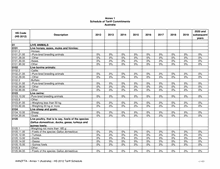

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8434.20.00 -Dairy machinery

0% 0% 0% 0% 0% 0% 0% 0% 0%

8434.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8435

Presses, crushers and similar machinery used in

the manufacture of wine, cider, fruit juices or

similar beverages:

8435.10.00 -Machinery

0% 0% 0% 0% 0% 0% 0% 0% 0%

8435.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436

Other agricultural, horticultural, forestry, poultry-

keeping or bee-keeping machinery, including

germination plant fitted with mechanical or

thermal equipment; poultry incubators and

brooders:

8436.10.00 -Machinery for preparing animal feeding stuffs

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.2

-Poultry-keeping machinery; poultry incubators and

brooders:

8436.21.00 --Poultry incubators and brooders

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.29.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.80

-Other machinery:

8436.80.10 ---Goods, as follows: (a) tree fellers; (b) tree

harvesters

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.80.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.9

-Parts:

8436.91.00 --Of poultry-keeping machinery or poultry incubators

and brooders

0% 0% 0% 0% 0% 0% 0% 0% 0%

8436.99.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8437

Machines for cleaning, sorting or grading seed,

grain or dried leguminous vegetables; machinery

used in the milling industry or for the working of

cereals or dried leguminous vegetables, other

than farm-type machinery:

8437.10.00 -Machines for cleaning, sorting or grading seed, grain

or dried leguminous vegetables

0% 0% 0% 0% 0% 0% 0% 0% 0%

8437.80.00 -Other machinery

0% 0% 0% 0% 0% 0% 0% 0% 0%

8437.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

335 / 433