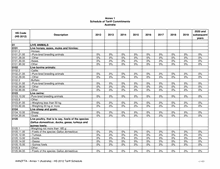

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

9503.00.10 ---Wheeled toys designed to be ridden by children

(for example, tricycles, scooters and pedal cars) and

similar wheeled toys; dolls' carriages

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.20 ---Dolls representing only human beings, including

parts and accessories for those dolls

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.30 ---Toys representing animals or non-human creatures 0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.40 ---Goods, as follows: (a) toy musical instruments and

apparatus; (b) books

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.50 ---Puzzles, other than books

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.60 ---Goods, as follows: (a) electric trains, including

tracks, signals and other accessories therefor; (b)

reduced-size ("scale") model assembly kits, whether

or not working models

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.70 ---Other goods, as follows: (a) construction sets and

constructional toys; (b) toys put up in sets or outfits

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.80 ---Other toys and models, incorporating a motor

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.9 ---Other:

9503.00.91 ----Of metal

0% 0% 0% 0% 0% 0% 0% 0% 0%

9503.00.99 ----Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

9504

Video game consoles and machines, articles for

funfair, table or parlour games, including

pintables, billiards, special tables for casino

games and automatic bowling alley equipment:

9504.20.00 -Articles and accessories for billiards of all kinds

0% 0% 0% 0% 0% 0% 0% 0% 0%

9504.30.00 -Other games, operated by coins, banknotes, bank

cards, tokens or by any other means of payment,

other than automatic bowling alley equipment

0% 0% 0% 0% 0% 0% 0% 0% 0%

9504.40.00 -Playing cards

0% 0% 0% 0% 0% 0% 0% 0% 0%

9504.5

-Video game consoles and machines, other than

those of 9504.30.00:

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

425 / 433