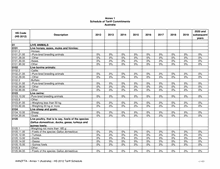

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

9401.90.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

9402

Medical, surgical, dental or veterinary furniture

(for example, operating tables, examination

tables, hospital beds with mechanical fittings,

dentists' chairs); barbers' chairs and similar

chairs, having rotating as well as both reclining

and elevating movements; parts of the foregoing

articles:

9402.10.00 -Dentists', barbers' or similar chairs and parts thereof

0% 0% 0% 0% 0% 0% 0% 0% 0%

9402.90.00 -Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403

Other furniture and parts thereof:

9403.10.00 -Metal furniture of a kind used in offices

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.20.00 -Other metal furniture

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.30.00 -Wooden furniture of a kind used in offices

5% 5% 5% 5% 5% 5% 5% 5% 0%

9403.40.00 -Wooden furniture of a kind used in the kitchen

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.50.00 -Wooden furniture of a kind used in the bedroom 0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.60.00 -Other wooden furniture

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.70.00 -Furniture of plastics

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.8

-Furniture of other materials, including cane, osier,

bamboo or similar materials:

9403.81.00 --Of bamboo or rattan

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.89.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

9403.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

9404

Mattress supports; articles of bedding and

similar furnishing (for example, mattresses,

quilts, eiderdowns, cushions, pouffes and

pillows) fitted with springs or stuffed or

internally fitted with any material or of cellular

rubber or plastics, whether or not covered:

9404.10.00 -Mattress supports

0% 0% 0% 0% 0% 0% 0% 0% 0%

9404.2

-Mattresses:

9404.21.00 --Of cellular rubber or plastics, whether or not

covered

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

423 / 433