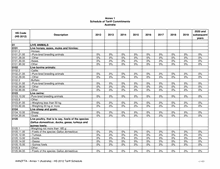

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8507

Electric accumulators, including separators

therefor, whether or not rectangular (including

square):

8507.10

-Lead-acid, of a kind used for starting piston engines:

8507.10.10 ---Of a kind used as components in passenger motor

vehicles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.10.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.20.00 -Other lead-acid accumulators

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.30.00 -Nickel-cadmium

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.40.00 -Nickel-iron

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.50.00 -Nickel-metal hydride

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.60.00 -Lithium-ion

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.80.00 -Other accumulators

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.90

-Parts:

8507.90.10 ---Of a kind used as components in passenger motor

vehicles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8507.90.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8508

Vacuum cleaners:

8508.1

-With self-contained electric motor:

8508.11.00 --Of a power not exceeding 1 500 W and having a

dust bag or other receptacle capacity not exceeding

20 L

0% 0% 0% 0% 0% 0% 0% 0% 0%

8508.19.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8508.60.00 -Other vacuum cleaners

0% 0% 0% 0% 0% 0% 0% 0% 0%

8508.70.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8509

Electro-mechanical domestic appliances, with

self-contained electric motor, other than vacuum

cleaners of 8508:

8509.40.00 -Food grinders and mixers; fruit or vegetable juice

extractors

0% 0% 0% 0% 0% 0% 0% 0% 0%

8509.80

-Other appliances:

8509.80.10 ---Floor polishers

0% 0% 0% 0% 0% 0% 0% 0% 0%

8509.80.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8509.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

366 / 433