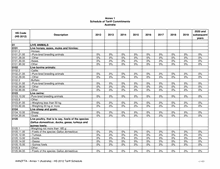

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8709

Works trucks, self-propelled, not fitted with

lifting or handling equipment, of the type used in

factories, warehouses, dock areas or airports for

short distance transport of goods; tractors of the

type used on railway station platforms; parts of

the foregoing vehicles:

8709.1

-Vehicles:

8709.11.00 --Electrical

0% 0% 0% 0% 0% 0% 0% 0% 0%

8709.19.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8709.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8710.00.00 Tanks and other armoured fighting vehicles,

motorised, whether or not fitted with weapons,

and parts of such vehicles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711

Motorcycles (including mopeds) and cycles fitted

with an auxiliary motor, with or without side-

cars; side-cars:

8711.10.00 -With reciprocating internal combustion piston engine

of a cylinder capacity not exceeding 50 cm

3

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711.20.00 -With reciprocating internal combustion piston engine

of a cylinder capacity exceeding 50 cm

3

but not

exceeding 250 cm

3

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711.30.00 -With reciprocating internal combustion piston engine

of a cylinder capacity exceeding 250 cm

3

but not

exceeding 500 cm

3

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711.40.00 -With reciprocating internal combustion piston engine

of a cylinder capacity exceeding 500 cm

3

but not

exceeding 800 cm

3

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711.50.00 -With reciprocating internal combustion piston engine

of a cylinder capacity exceeding 800 cm

3

0% 0% 0% 0% 0% 0% 0% 0% 0%

8711.90.00 -Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8712.00.00 Bicycles and other cycles (including delivery

tricycles), not motorised

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

398 / 433