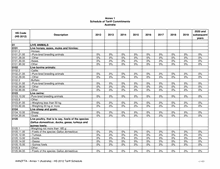

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8453

Machinery for preparing, tanning or working

hides, skins or leather or for making or repairing

footwear or other articles of hides, skins or

leather, other than sewing machines:

8453.10.00 -Machinery for preparing, tanning or working hides,

skins or leather

0% 0% 0% 0% 0% 0% 0% 0% 0%

8453.20.00 -Machinery for making or repairing footwear

0% 0% 0% 0% 0% 0% 0% 0% 0%

8453.80.00 -Other machinery

0% 0% 0% 0% 0% 0% 0% 0% 0%

8453.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8454

Converters, ladles, ingot moulds and casting

machines, of a kind used in metallurgy or in

metal foundries:

8454.10.00 -Converters

0% 0% 0% 0% 0% 0% 0% 0% 0%

8454.20.00 -Ingot moulds and ladles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8454.30.00 -Casting machines

0% 0% 0% 0% 0% 0% 0% 0% 0%

8454.90.00 -Parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8455

Metal-rolling mills and rolls therefor:

8455.10.00 -Tube mills

0% 0% 0% 0% 0% 0% 0% 0% 0%

8455.2

-Other rolling mills:

8455.21.00 --Hot or combination hot and cold

0% 0% 0% 0% 0% 0% 0% 0% 0%

8455.22.00 --Cold

0% 0% 0% 0% 0% 0% 0% 0% 0%

8455.30.00 -Rolls for rolling mills

0% 0% 0% 0% 0% 0% 0% 0% 0%

8455.90.00 -Other parts

0% 0% 0% 0% 0% 0% 0% 0% 0%

8456

Machine-tools for working any material by

removal of material, by laser or other light or

photon beam, ultrasonic, electro-discharge,

electro-chemical, electron beam, ionic-beam or

plasma arc processes; water-jet cutting

machines:

8456.10.00 -Operated by laser or other light or photon beam

processes

0% 0% 0% 0% 0% 0% 0% 0% 0%

8456.20.00 -Operated by ultrasonic processes

0% 0% 0% 0% 0% 0% 0% 0% 0%

8456.30.00 -Operated by electro-discharge processes

0% 0% 0% 0% 0% 0% 0% 0% 0%

8456.9

‑

Other:

8456.90.10 ---Water-jet cutting machines

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

343 / 433