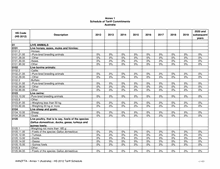

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

8207.60.00 -Tools for boring or broaching

0% 0% 0% 0% 0% 0% 0% 0% 0%

8207.70.00 -Tools for milling

0% 0% 0% 0% 0% 0% 0% 0% 0%

8207.80.00 -Tools for turning

0% 0% 0% 0% 0% 0% 0% 0% 0%

8207.90.00 -Other interchangeable tools

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208

Knives and cutting blades, for machines or for

mechanical appliances:

8208.10.00 -For metal working

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208.20.00 -For wood working

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208.30.00 -For kitchen appliances or for machines used by the

food industry

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208.40

-For agricultural, horticultural or forestry machines:

8208.40.10 ---Designed for use with wood chipping machines

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208.40.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8208.90.00 -Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8209.00.00 Plates, sticks, tips and the like for tools,

unmounted, of cermets

0% 0% 0% 0% 0% 0% 0% 0% 0%

8210.00.00 Hand-operated mechanical appliances, weighing

10 kg or less, used in the preparation,

conditioning or serving of food or drink

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211

Knives with cutting blades, serrated or not

(including pruning knives), other than knives of

8208, and blades therefor:

8211.10.00 -Sets of assorted articles

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211.9

-Other:

8211.91.00 --Table knives having fixed blades

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211.92

--Other knives having fixed blades:

8211.92.10 ---Kitchen knives, butchers' knives and

slaughtermen's knives

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211.92.90 ---Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211.93.00 --Knives having other than fixed blades

0% 0% 0% 0% 0% 0% 0% 0% 0%

8211.94

--Blades:

8211.94.10 ---For table knives, kitchen knives, butchers' knives

and slaughtermen's knives

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

312 / 433