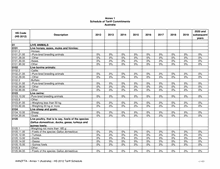

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

7211.2

-Not further worked than cold-rolled (cold-reduced):

7211.23.00 --Containing by weight less than 0.25% of carbon

0% 0% 0% 0% 0% 0% 0% 0% 0%

7211.29.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

7211.90.00 -Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212

Flat-rolled products of iron or non-alloy steel, of

a width of less than 600 mm, clad, plated or

coated:

7212.10.00 -Plated or coated with tin

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212.20.00 -Electrolytically plated or coated with zinc

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212.30.00 -Otherwise plated or coated with zinc

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212.40.00 -Painted, varnished or coated with plastics

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212.50.00 -Otherwise plated or coated

0% 0% 0% 0% 0% 0% 0% 0% 0%

7212.60.00 -Clad

0% 0% 0% 0% 0% 0% 0% 0% 0%

7213

Bars and rods, hot-rolled, in irregularly wound

coils, of iron or non-alloy steel:

7213.10.00 -Containing indentations, ribs, grooves or other

deformations produced during the rolling process

0% 0% 0% 0% 0% 0% 0% 0% 0%

7213.20.00 -Other, of free-cutting steel

0% 0% 0% 0% 0% 0% 0% 0% 0%

7213.9

-Other:

7213.91.00 --Of circular cross-section measuring less than 14

mm in diameter

0% 0% 0% 0% 0% 0% 0% 0% 0%

7213.99.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

7214

Other bars and rods of iron or non-alloy steel,

not further worked than forged, hot-rolled, hot-

drawn or hot-extruded, but including those

twisted after rolling:

7214.10.00 -Forged

0% 0% 0% 0% 0% 0% 0% 0% 0%

7214.20.00 -Containing indentations, ribs, grooves or other

deformations produced during the rolling process or

twisted after rolling

0% 0% 0% 0% 0% 0% 0% 0% 0%

7214.30.00 -Other, of free-cutting steel

0% 0% 0% 0% 0% 0% 0% 0% 0%

7214.9

-Other:

7214.91.00 --Of rectangular (other than square) cross-section

0% 0% 0% 0% 0% 0% 0% 0% 0%

7214.99.00 --Other

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

285 / 433