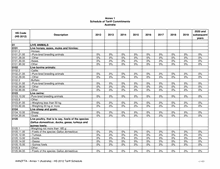

HS Code

(HS 2012)

Description

2012 2013 2014 2015 2016 2017 2018 2019

2020 and

subsequent

years

Annex 1

Schedule of Tariff Commitments

Australia

6804

Millstones, grindstones, grinding wheels and the

like, without frameworks, for grinding,

sharpening, polishing, trueing or cutting, hand

sharpening or polishing stones, and parts

thereof, of natural stone, of agglomerated natural

or artificial abrasives, or of ceramics, with or

without parts of other materials:

6804.10.00 -Millstones and grindstones for milling, grinding or

pulping

0% 0% 0% 0% 0% 0% 0% 0% 0%

6804.2

-Other millstones, grindstones, grinding wheels and

the like:

6804.21.00 --Of agglomerated synthetic or natural diamond

0% 0% 0% 0% 0% 0% 0% 0% 0%

6804.22.00 --Of other agglomerated abrasives or of ceramics

0% 0% 0% 0% 0% 0% 0% 0% 0%

6804.23.00 --Of natural stone

0% 0% 0% 0% 0% 0% 0% 0% 0%

6804.30.00 -Hand sharpening or polishing stones

0% 0% 0% 0% 0% 0% 0% 0% 0%

6805

Natural or artificial abrasive powder or grain, on

a base of textile material, of paper, of paperboard

or of other materials, whether or not cut to shape

or sewn or otherwise made up:

6805.10.00 -On a base of woven textile fabric only

0% 0% 0% 0% 0% 0% 0% 0% 0%

6805.20.00 -On a base of paper or paperboard only

0% 0% 0% 0% 0% 0% 0% 0% 0%

6805.30.00 -On a base of other materials

0% 0% 0% 0% 0% 0% 0% 0% 0%

6806

Slag wool, rock wool and similar mineral wools;

exfoliated vermiculite, expanded clays, foamed

slag and similar expanded mineral materials;

mixtures and articles of heat-insulating, sound-

insulating or sound-absorbing mineral materials,

other than those of 6811 or 6812 or of Chapter

69:

6806.10.00 -Slag wool, rock wool and similar mineral wools

(including intermixtures thereof), in bulk, sheets or

rolls

0% 0% 0% 0% 0% 0% 0% 0% 0%

AANZFTA - Annex 1 (Australia) - HS 2012 Tariff Schedule

264 / 433